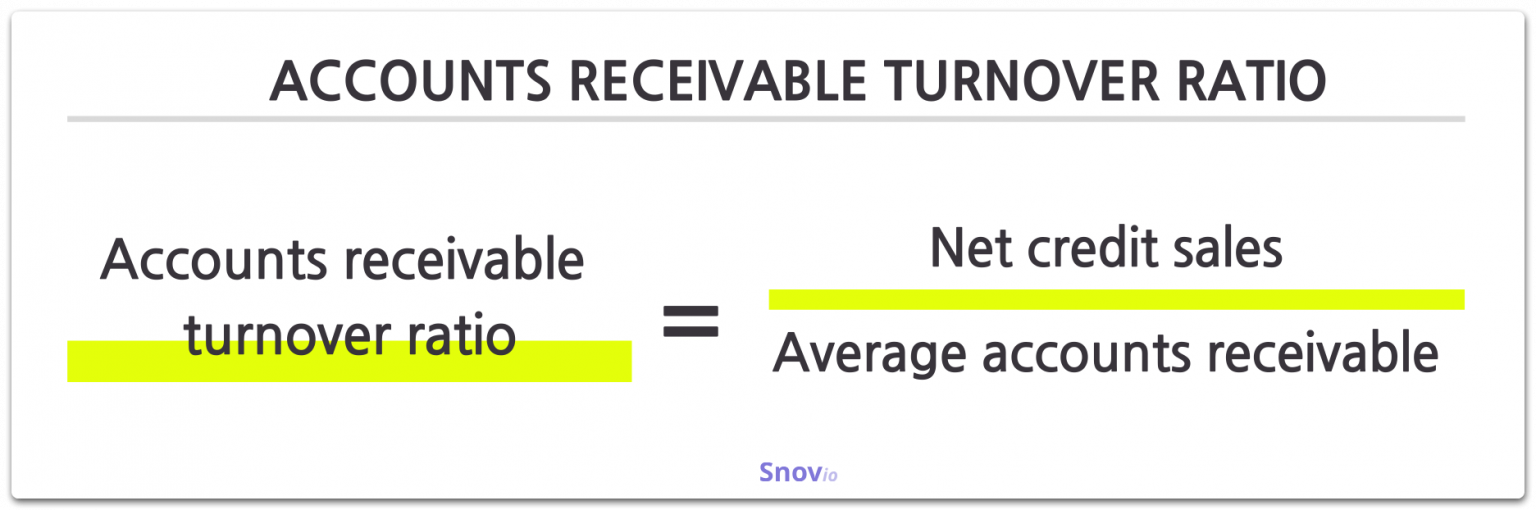

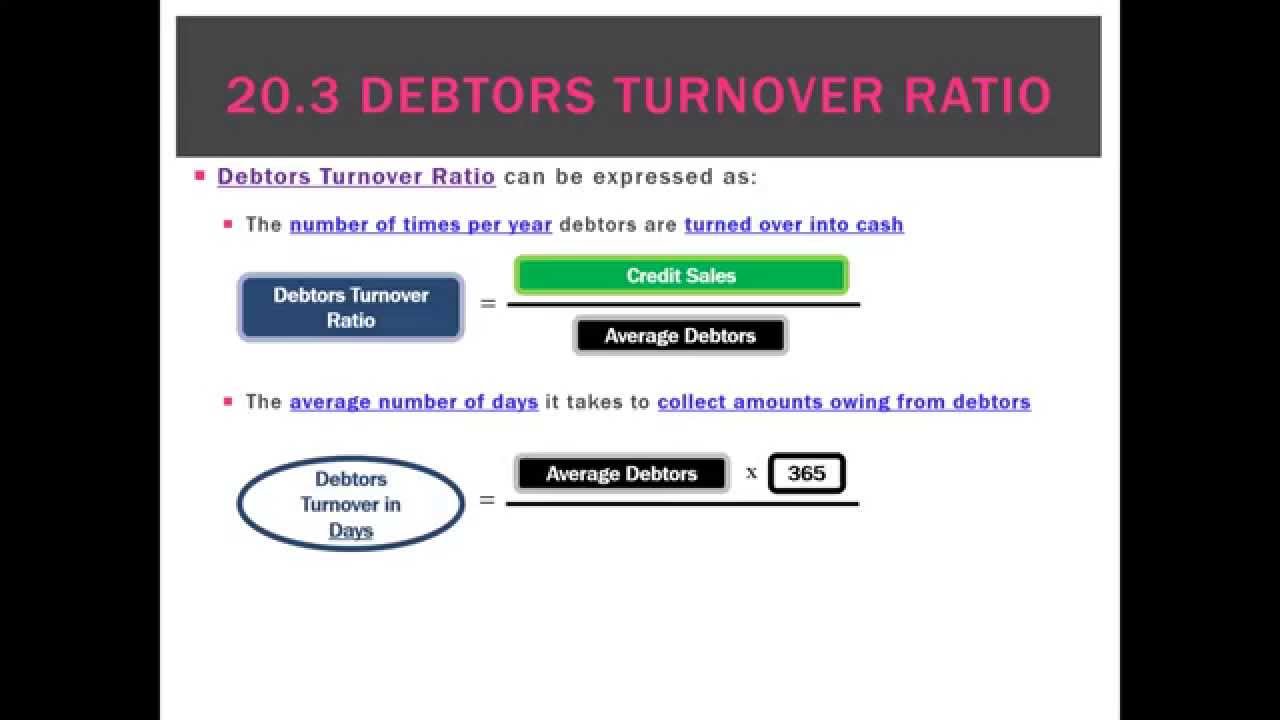

This allows companies to forecast how much cash they’ll have on hand so they can better plan their spending. Finance teams can use AR turnover ratio when making balance sheet forecasts, as it provides a general expectation of when receivables will be paid. Tracking accounts receivable turnover ratio shows you how quickly the company is converting its receivables into cash on an average basis. It refers to the number of times during a given period (e.g., a month, quarter, or year) the company collected its average accounts receivable.

#Turnover ratio how to#

This can go a long way in making a successful investment and therefore an investor must learn how to use these ratios to his/her advantage.What is accounts receivable turnover ratio and why is it important?Īccounts receivable turnover ratio, also known as receivables turnover ratio or debtor’s turnover ratio, is a measure of efficiency. In conclusion, turnover ratios provide early clues to the efficiency of a firm. This is because inventory is reported at the cost price. In case of inventory turnover ratio we use the COGS figure listed on the income statement rather than the sales figure. On the other hand when we compare accounts receivable to sales we get accounts receivable turnover ratio. For example if we compare fixed assets to sales, we get fixed asset turnover ratio. sales and the corresponding balance sheet item. The logic is that given a certain amount of assets, how much sales can a company achieve? Therefore turnover ratios are always a comparison between an income statement item i.e. Turnover ratios as the name suggest, are related to sales. The Link between Sales, COGS and Turnover They then aggregate this information together and make meaningful conclusions about the operations of the company. They use information which is available in different financial statements. The turnover ratios are the investors method to connect the dots. This is possible because every activity done by the firm involves costs and therefore leaves a trail on the financial statements. They have to use these financial statements as their window into the operations of the firm. Investors on the other hand just have the financial statements. A Look at Efficiency through Financial Statementsįinding out whether the firm is efficient is difficult even for a manager or an employee who has all the information at hand.

It is for this reason that investors carefully look at the efficiency numbers of newbie firms. This is like an investors dream formula for success.

This profitability will allow the firm to build a competitive moat around itself and these businesses often become very valuable. Any firm which is more efficient than its peers in producing the same goods and services will be more profitable in the short run. Over the years, investors have realized one rule and that is ∾fficiency means growing business. Here is an elementary introduction to what turnover ratios are and why they are important. This is because judgments have to be made about the efficiency of the firm based on limited information at hand. However, we are going to consider these ratios from the point of view of outside investors. These ratios are not only used by financial personnel but also by the people in charge of operations. Turnover ratios (also known as efficiency ratios) are a very important class of ratios.

0 kommentar(er)

0 kommentar(er)